Donate

Help us achieve our mission to open up new possibilities and pave the way to independence for individuals with disabilities.

Help our participants find a place to belong!

Donating online is the quickest, easiest way to support us. Your financial support will help us continue to build confident, connected and fulfilled lives for people with developmental disabilities. Click the button below for our online donation form.

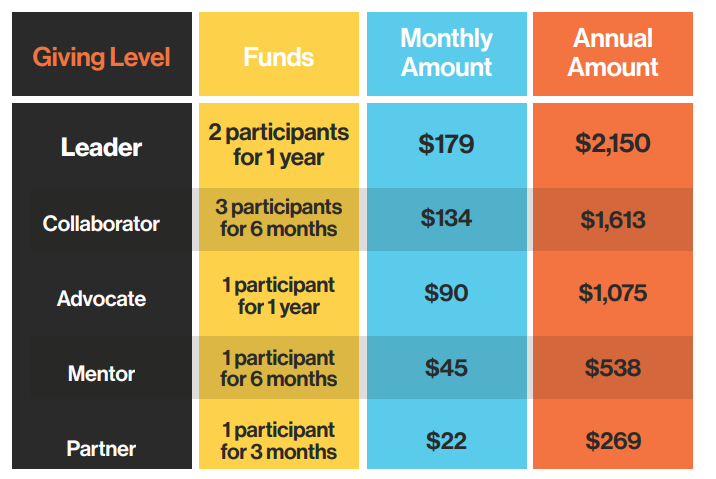

Become a Connector

By becoming a Connector for Pathways’ participants, you support access to our Social Growth program! It may seem like a simple thing – for people to feel a true sense of belonging. But if it’s something you haven’t felt before, it is truly life-changing! And that’s what Pathways is for our participants… life-changing!

Other ways to give

IRA Contribution

Anyone 70.5 years of age or older can give up to $100,000 as a tax-free gift, in the form of a QCD, from their traditional IRA account.The donor can direct their financial institution to send a check on their behalf (check

goes directly to the charity). For more information, please contact Liz Cottrell at liz@ptistl.org or 314-863.0202 ext. 0.

Matching gift

Many employers sponsor matching gift programs and will match any charitable contributions or volunteer hours made by their employees.

For more information, please contact Liz Cottrell at liz@ptistl.org or 314-863.0202 ext. 0.

Donor-advised funds

Donor-advised funds are the fastest-growing giving method and most tax-efficient way to manage charitable donations. Donor-advised funds allow donors to make a charitable contribution, receive an immediate tax deduction and then recommend grants from the fund over time.

Grants made to Pathways to Independence through donor-advised funds can be designated for Pathways to Independence to use wherever the need is greatest.

Clients of Fidelity Charitable, Schwab Charitable and BNY Mellon can easily make a designation through the DAF Direct window on this page.

Pathways to Independence’s tax I.D. number is 43-1504762.

Stock donation

A gift of appreciated securities, including stocks or bonds, is an easy way for you to make a gift. The best stocks to donate are those that have increased greatly in value, particularly those producing a low yield. Even if it is stock you wish to keep in your portfolio, by giving us the stock and using cash to buy the same stock through your broker, you will have received the same income tax deduction but will have a new, higher basis in the stock.<

Benefits of making a gift of stock include:

- Avoid paying capital gains tax

- Receive a charitable income tax deduction

- Enjoy possible increased income

- Further our mission today

For more information, please contact Liz Cottrell at liz@ptistl.org or 314-863.0202 ext. 1.

Planned gift

1. Choose your gift vehicle.

Charitable Bequests are assets that pass to a charity at the death of the donor through a will, trust, or beneficiary designation. Assets may include cash, marketable securities, closely held stock, real estate, tangible personal property or other investments. You can arrange to bequeath a gift in several different ways, including a specific dollar amount, a percentage of your estate or from assets remaining after providing for family members. A bequest is a good option for smaller estates.

Life Insurance is a wonderful tool for a donor’s family because its value is set and does not fluctuate with the market. In addition, you may find that your life insurance policies are no longer necessary, for instance, if you have survived a spouse or have grown children.

We may be designated as a beneficiary on all or part of a retirement plan asset including a pension plan, 401(k) or 403(b) plan, Individual Retirement Account (IRA), profit-sharing plan or stock bonus plan. This may be a great way for you to provide a legacy gift while receiving potential tax benefits.

Pathways to Independence may also be designated as a remainder beneficiary of a Special Needs Trust. If any assets remain in the trust at the time of death of the life beneficiary, they may be distributed to the named remainder beneficiaries.

2. Choose how Pathways to Independence will use your gift.

Reserve funds are invested monies that are set apart as principal for general or specific purposes. If you wish to make an endowment gift to Pathways to Independence, you can make an unrestricted gift of any size to the general reserve fund. Unrestricted gifts are used in the most beneficial way at the time of the gift. Alternatively, you may wish to make a restricted gift by establishing either a named endowment fund or an area of interest endowment fund. Restricted gifts allow you to specify how we will utilize your donation and can be established with a minimum donation of $25,000. If you wish to make a restricted gift, please contact us in advance in order to be certain that your intent can be fulfilled.

3. Meet with professionals.

Whether you need to create estate planning documents or update your current documents, you’ll want to seek the help of estate planning professionals. Please note the information contained on this page is intended to provide general guidance and is not a substitute for professional counsel. Consult your tax or legal advisor for professional guidance.

4. Share your intent.

If you have included us in your estate plans, we ask that you confidentially share your intent with us. Please note that donors may choose to remain anonymous.

For more information, please contact Liz Cottrell at liz@ptistl.org or 314-863.0202 ext. 0.